A reserve study is a budgeting tool that can be utilized to make more informed budgeting decisions regarding a reserve account. It is an independent assessment of the adequacy of the reserve account, and the main purpose of the reserve study is to disclose to the Client and dues paying Members the current adequacy of the reserve account (Percent Funded Calculation).

Within a reserve study you will find:

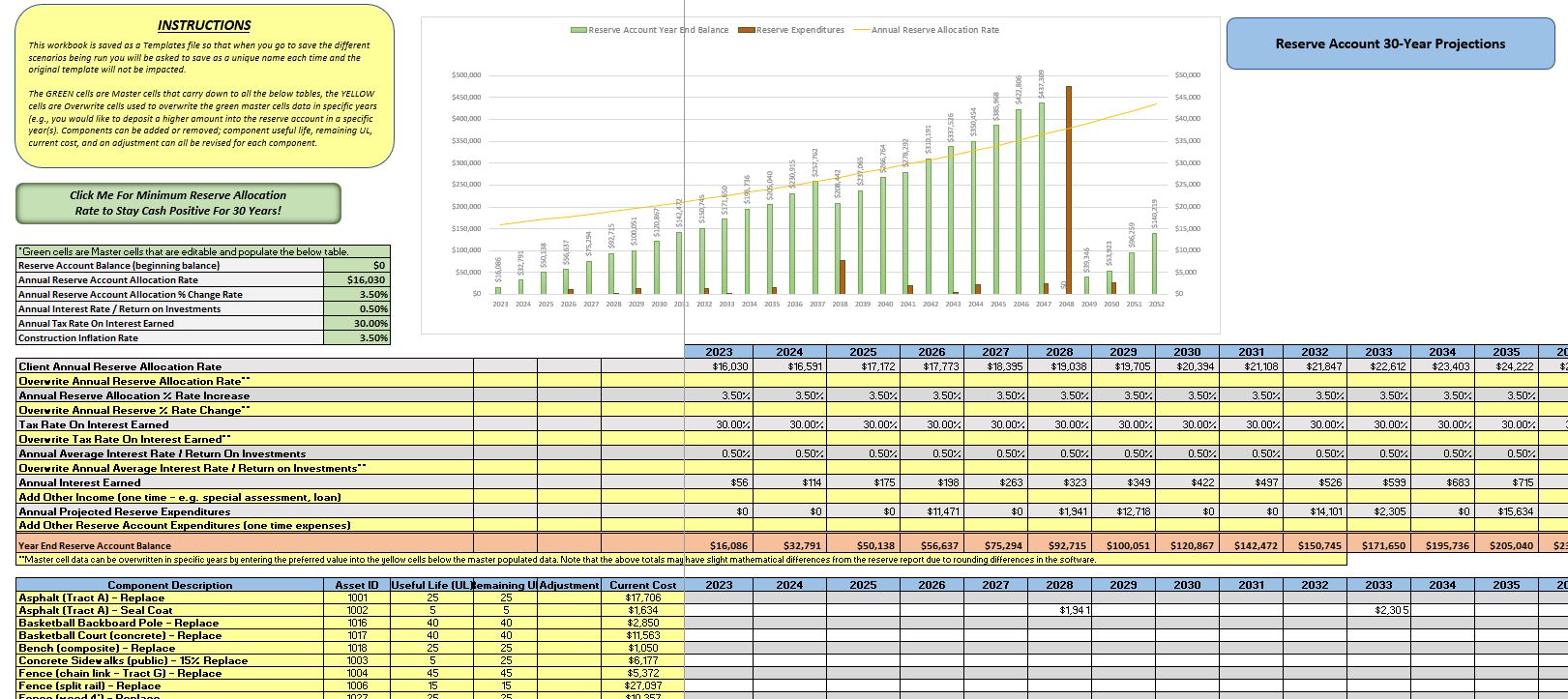

- A list of the site and building components that are reportedly the Client’s responsibility; everything from irrigation piping to lighting, paint, siding, roofing, etc. (The Component List)

- An estimated current cost and projected cost for each of the component repair/replacement projects. (The Component List & Projected Expenditures Report)

- A timeline of the estimated dates that we recommend funds be allocated to the repair/replacement project. (Projected Expenditures Report)

Included in our reserve studies are various funding models with different goals in mind (e.g. only staying cash positive). Keep in mind that funding models that remain in the Low Percent Funded range for an extended period will carry a much higher risk for reliance on special assessments, loans or deferring projects should some of the component projects occur sooner than projected.

The Reserve Analyst develops funding models that:

> As fairly as possible distribute the costs amongst all the dues paying members over time

> Have stable budgets over time (i.e. limiting large fluctuations from one year to the next)

> Limit the risk for reliance on special assessments and loans.

A Reserve Study is Not The Budget !

The reserve study is not the budget, and it should not be revised to just reflect the budgeting decisions of the Client. An example of this is to push off overdue projects that the Client may not have the funds to complete. The reserve study should reflect the replacement dates of the components utilizing average useful lives and average costs for these projects (or specific if available from the Vendor); the useful lives can be updated to reflect actual on site conditions as the components age and deteriorate (note that some components will deteriorate faster and others slower than what was initially projected). Should the Client decide to defer projects that appear to be overdue this is simply a budgeting decision that carries its own risk (e.g. not painting wood siding at regular cycles carries a higher risk for rot developing due to water intrusion).

If the reserve study has significant revisions that are only incorporated to reflect the Client’s budgeting decisions, such as removing a component expense due to a lack of funds, the reserve study no longer becomes an independent assessment of the reserve account and will no longer serve its main purpose of independence and disclosure.

It is important to remember that virtually every community that is severely underfunded has typically had years or decades of creating budgets, meetings regarding reserve budgeting and decisions making reading reserve projects, but most still end up severely underfunded and are left precarious financial positions. Some interesting data we have found after working with thousands of communities over the years include:

> The typical "in-house" reserve budget is missing 80% of the cost and 80% of the components.

> Most communities are around 20% funded (i.e., they have collected about 20% of the money they ideally should have).

> Most large reserve project expenses occur at 25-year increments (e.g., asphalt, roofing, decks, siding, windows, plumbing, electrical)

> Most special assessments and loans occur when communities are around 25 years old and again when it is 50 years old.

> Most communities contact us for professional guidance right around 25 and 50 years of age. This is not a coincidence!